While many buyers wait for interest rates to drop, a 50-year mortgage could provide immediate relief, but at what cost?

Have you been wondering whether there’s any real solution to today’s rising home prices and high mortgage rates? A new idea has been making headlines: the proposal to introduce 50-year mortgages in the United States. It’s being presented as a way to make housing more affordable.

Before you get excited or skeptical, I want to break down what this could actually mean for you, the market, and the future of homeownership.

Why the idea of 50-year mortgages is gaining attention. President Donald Trump floated the idea of launching 50-year mortgages. The goal behind this proposal is simple: lower monthly payments. By stretching a loan over five decades, buyers could dramatically reduce their monthly payments and potentially afford more house for their dollar.

On the surface, that sounds appealing, but the ripple effects of a loan this long are worth looking at closely.

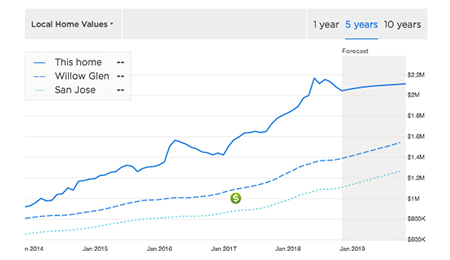

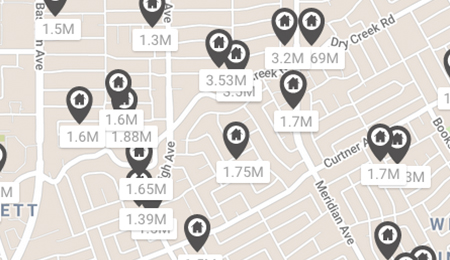

Lower payments could lead to higher prices. The first big effect stems from affordability and demand. Longer mortgage terms mean smaller monthly payments, which increases affordability on paper. But when more people can afford more homes, demand surges, and when demand surges, prices rise.

“The 50-year mortgage is being sold as relief, but the reality is harder to ignore.”

So while a 50-year mortgage may make the monthly payment easier, it could also make homes more expensive overall as prices climb to match that increased demand.

Longer loan terms could delay wealth building. Traditionally, the 30-year mortgage has been one of the main ways Americans build wealth. You pay down your principal, slowly build equity, and eventually own your home outright.

But with a 50-year loan, equity builds much more slowly. That changes the way people build long-term financial security through homeownership. Instead of being a strong wealth-building tool, a 50-year mortgage could begin to feel more like a long-term rental with a title, where ownership grows very little over time.

This could encourage risky lending practices. There’s also a historical lesson to consider. If the 2008 crash taught us anything, it’s that unconventional loan structures can attract risky behaviors.

A 50-year mortgage might create a false sense of affordability. Buyers who are financially stretched may jump into a loan they believe they can handle simply because the monthly payment looks lighter. But if interest rates rise, market conditions shift, or property values fall, many could end up underwater with very little equity.

Market timing matters more than loan length. Right now, mortgage rates are high, and affordability is a major concern, which is part of why the idea of 50-year loans is gaining traction.

But extending the loan term doesn’t solve the deeper issues. Until wages go up and housing supply increases, a 50-year mortgage might treat the symptom, not the cause, of today’s housing challenges.

If you’re buying or refinancing, it’s important to know if a long-term mortgage fits your goals. A 50-year loan might help some, but it’s not right for everyone. I can help you choose terms that truly benefit you, rather than adding decades of debt.

If you ever want to talk through your options, feel free to reach out at (408) 317-0506, email Brett@TheRealExperts.com, or visit therealexperts.com. Let’s make sure your next move is a smart one.