A lot of people have been wondering if the Silicon Valley real estate market has peaked. Today we’re taking a closer look to determine whether that’s the case or not.

Considering Selling? Click here for a FREE Home Price Evaluation

Click here to access off-site properties

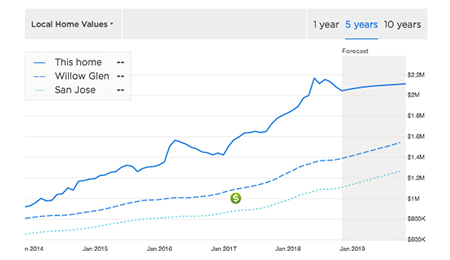

With Silicon Valley home prices up by 25% this year already, many area property owners are wondering whether prices can go higher or the market has hit its peak. I’ve got a fall market update for you today that will answer that question.

To understand where this market is headed, we have to understand what’s been driving it up in the first place. Real estate is a supply-and-demand driven market, but there is an affordability ceiling.

For most real estate markets around the country, a balanced inventory means we have about six months of supply. This means that if no other homes came on the market, all the available homes would be bought in six months. Right now in Silicon Valley, we have only six weeks of inventory available, which is actually up 50% year over year.

What’s keeping our inventory constrained? A few different things. First, retirees aren’t moving. In fact, 87% of retirees are staying in their current homes as opposed to relocating or downsizing. Another factor is move-up buyers. Buyers who purchased their home five to 10 years ago and want to purchase a larger home now are facing the prospect of a property tax bill that is double or triple what they’re currently paying. For that reason, these would-be sellers are deciding to remodel or expand instead. Lastly, anyone who has bought a house in the last five years likely has a very low interest rate. If they decide to buy, they will see their interest rate increase almost by 50%. Many are choosing to remodel or expand their current properties, instead.

“HOME PRICES ARE RISING FASTER THAN WAGES ARE.”

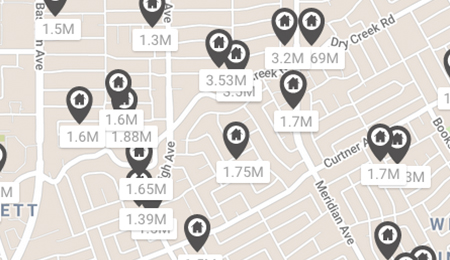

What drives demand in real estate? Jobs. In Silicon Valley, there are plenty of them. Last year, 47,000 new jobs were created and 22,000 people moved here. The real issue is that only 12,000 new housing permits were issued, mostly for condos and apartments. As you can see, we have a low supply and high demand, which has driven the market higher. You would think there would be no end in sight, but buyers can only stretch so far, which goes back to the affordability ceiling I discussed earlier.

As higher and higher paid workers chase higher and higher priced homes, we get to a point where house prices are going up faster than wages. No matter where you work, you probably didn’t get a 25% raise this year to keep pace with home prices.

59% of tech workers surveyed said they couldn’t afford the house they live in with today’s prices and interest rates. Only 34% of first-time buyers entering this market can afford to buy a home right now. This means that our market hit its peak this summer. We’ve seen prices come off the top by about 6% since this June.

If you’re a home seller, it’s a great time to list. Prices are still near all-time highs. If you’re a buyer, inventory is opening up and prices are down a bit. There’s a great window for you to come in and buy your dream home. Either way, the time to buy or sell is now.

If you have any questions about the market or want to discuss your buying or selling plans further, don’t hesitate to give me a call or send me an email. I look forward to hearing from you soon.