How can you sell a home when you also want to buy another? Today, we’ll go over four options.

Considering Selling? Click here for a FREE Home Price Evaluation

Click here to access off-site properties

Juggling two real estate transactions can seem like a daunting task. In fact, one of my most frequently asked questions is about how to sell a home while also wanting to buy another.

Many people are confused about the right way to approach a situation like this. Should you buy first or should you sell first?

Truthfully, there are four ways you can navigate this kind of situation.

The first way is by having something called a contingent purchase. What this means is that when you go out onto the market, find a home you like, and make an offer, you will include a condition on your offer that states that it is contingent upon you listing and selling your home.

To put it simply, this tells the seller that your offer will only be valid in the event that you are successful in listing and selling your own home.

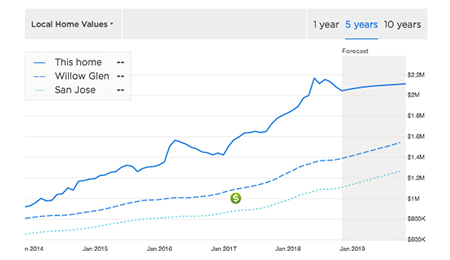

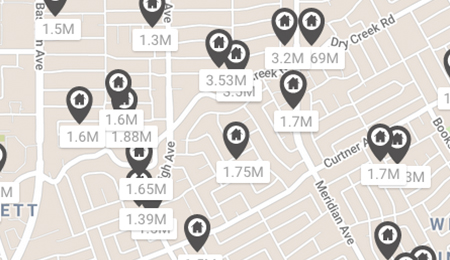

However, with Silicon Valley currently in a seller’s market, buyers are facing a lot of competition. Any home you place an offer on will likely be receiving several other offers that are free of contingencies. Unfortunately, this puts your offer at a disadvantage.

The second route also has to deal with contingencies. However, with this option, you sell your home first. In a contingent sale, you, as the seller, would tell the buyer whose offer you’ve chosen that you will only proceed with selling your home once you have successfully closed on another, yourself.

“COMPLETING TWO TRANSACTIONS ONE AFTER ANOTHER MAY BE EASIER THAN YOU THINK.”

While this still isn’t the best option, it is better than the first. Sellers have a lot more power to utilize these kinds of stipulations in today’s current market.

Even though this second route is better than the first, our next option is even better still.

A bridge loan is another way you can achieve the feat of completing two transactions one after another. With this solution, you will get pre-approved for your new home while taking equity from your old to help with financing. The drawback to this option, though, is that it will require you to have quite a bit of income.

Finally, you might also consider negotiating a rent-back. By taking this route, you’ll place your home on the market first. This is the most common option and is also very, very effective.

Basically, when you receive an offer on your home, you’ll negotiate with the buyer on an amount of time during which you can rent back your property while looking for your next.

We’ve personally helped dozens, if not hundreds, of homeowners using this process. Completing two transactions one after another may be easier than you think.

If you have any other questions or would like more information, feel free to give me a call or send me an email. I look forward to hearing from you soon.