Although our stock market may be dipping, our real estate market is on fire! We know this in part because open houses are one of the leading indicators of our real estate market’s overall health.

Our team held an open house recently and over 181 buyers came through. When it came to the day to take offers, we ended up with 24 offers on that property, which ended up selling for more than $161,000 over the asking price.

“Whether you’re buying or selling, the time to act is now.”

What’s driving this surge in Silicon Valley real estate? There are three reasons why this market is on fire:

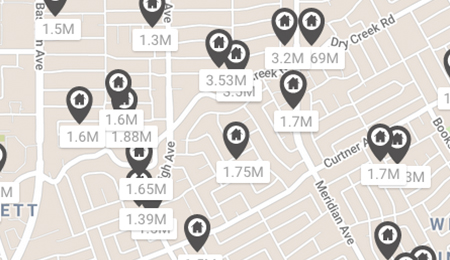

1. Inventory is at an all-time low. We only have 237 homes for sale in San Jose, whose population is over a million people. This is the lowest recorded number of homes for sale since we started recording those numbers.

2. Interest rates are near all-time lows, as well. The coronavirus, which is shaking up the stock market, has also driven interest rates down, making homes more affordable for buyers.

3. The stock market is near all-time highs. Buyers in our market who work for Apple, Netflix, PayPal, Google, etc., who have stock in their accounts are feeling pretty flushed, and that’s also driving the market.

So what does this mean for buyers and sellers?

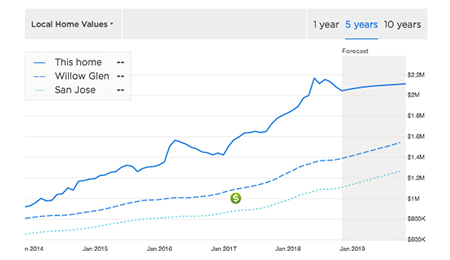

For buyers, the last time we saw these conditions was the beginning of 2017 when we saw a huge surge in prices. Home prices will likely rise and interest rates aren’t likely to go any lower than they already have.

For sellers, remember that we’re coming up on an election year. Typically in real estate, once we hit the primaries in the summertime, buyers and sellers will take a step back and see who is going to come into power and what that will mean for taxes, interest rates, and so on. During our last election in 2015, we saw a slowdown in the market as well, so if you’re thinking of selling, you’ll want to take advantage of the current momentum of our spring market.

The bottom line is that whether you’re buying or selling, the time to act is now. If you’re considering jumping into the market, feel free to reach out to me for any questions you have. I look forward to discussing your plans and how we might be able to help.