Prices are up 22% year-over-year, and that has a lot of people asking what is driving the increase. Real estate is a supply-and-demand-driven industry that is also tempered by interest rates and the stock market. Given that, there are four factors that are driving our market higher and higher in 2021.

1. Work from home. People working at home have untethered our workforce and increased demand for new homes. The number of home sales is up 71% over last year.

2. Lowest supply in three years. The graph at 1:27 in the video shows that our inventory is down 33% from last year, and even last year’s supply was down from the year before.

3. Interest rates are low. You can think of interest rates almost as the price of money. When money is inexpensive, things start to cost more. We are seeing historically low rates at the moment.

4. The stock market is climbing. The NASDAQ is up over 36% in the last twelve months. This puts plenty of money in the pockets of potential buyers out there.

“We have a flaming-hot real estate market; however, it is not sustainable at this level.”

All of this combines to give us a flaming hot real estate market. However, it is not sustainable at this level. So here’s our prediction going forward:

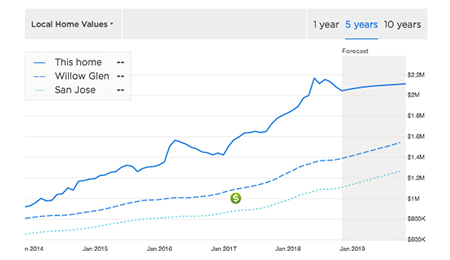

• Prices will rise, but more slowly. Our prices have been rising rapidly. We expect increases still, but just not as quickly as these last few years.

• Interest rates will rise. We are starting to see signs of inflation, and the only option the government has to protect us from that is increasing interest rates. So we expect those to climb over the next few years.

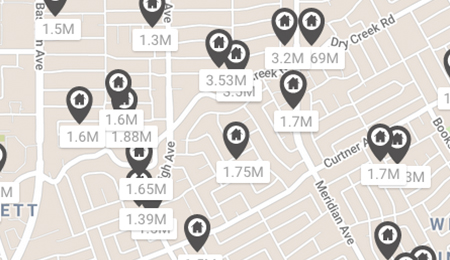

So if you’re thinking about buying, now is the time. If you’re thinking about selling, prices are at an all-time high, and we don’t know how long that will last. At the end of the day, whether buying or selling, the time is right in real estate. If you’re wondering if the time is right for you, reach out to us. We’ll gladly provide a consultation and help you make a plan. We look forward to hearing from you soon.