How to Finance Major Home Improvement Projects

Considering Selling? Click here for a FREE Home Price Evaluation

Click here to access off-site properties

In our last blog we spoke about the five most valuable home improvement projects that you can do on your home (see below). We realize that some of these projects can get pricey, and because of that we’re going to provide you with ways in which you can fund them.

Most of the repairs that we mentioned in the last video would cost $50,000 or less, and are all common fix-ups that you would do prior to putting your home on the market. If you do plan to sell your home after making these repairs, my team does offer an in-house financing plan. These costs can be carried through the close of Escrow so they don’t have to come directly out of your pocket.

Other options for funding projects (less than $50K) would be to take out a Home Equity Line of Credit (HELOC). This is basically a second mortgage that goes behind your first mortgage and allows you to draw money for your project.

For home repairs that are a little more extensive ($50K-$250K), such as when someone wants to mold a property into their dream home, you will have a few different financing options. You can either take a HELOC like we have just talked about, or you can opt for a Cash Out Refinance Option. The major downside to a HELOC is that the loan is adjustable, so as the loan amount increases you might pay more and we are also in a market with rising interest.

The Cash Out Loan is preferable for these projects because it is fixed-rate loan and it’s all one simple payment. If your current loan is above 4% then the Cash Out Loan is probably your better option, and if it is in the low 3’s then a HELOC is probably a better consideration.

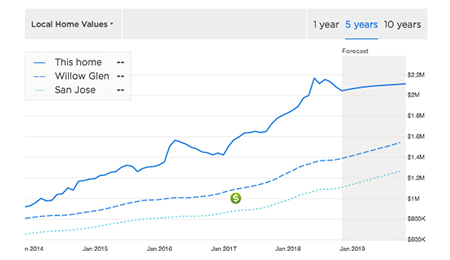

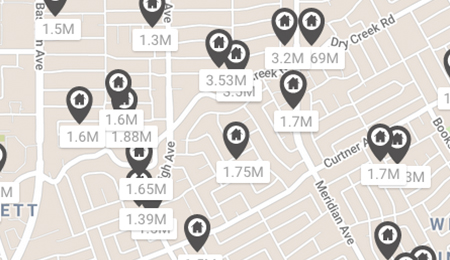

The third type of project we’re seeing in Silicon Valley is where people are completely rebuilding their homes in order to compete with soaring home values of newly-built properties. You would want to consider a Construction Loan in this case. Generally these projects are $500,000 and more. These projects are highly expensive and require special funding.

Hopefully this information has been useful to you. If you’re interested in learning more about this type of financing or would like to speak with me about Silicon Valley real estate, then please do not hesitate to give me a call.