The National Association of Realtor’s (NAR) existing home sales report for April 2020 reported that the Median Sales Price rose a staggering 7.4% year-on-year. April’s increase marks 98 straight months of year-on-year increase.

Even a more recent data (for the week ending May 15, 2020) from Altos Research shows that the Median Sales Price is still increasing.

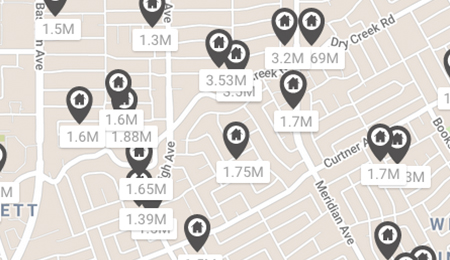

This, when 38 million Americans have lost their jobs and the unemployment rate is at the highest levels since the Great Depression of 1933, mostly due to Covid-19 pandemic (see chart below).

It seems that all the prediction of doom and gloom for the real estate prices are yet to materialize.

So why isn’t the falling economy bringing home prices down with it? We all know that the last economic crisis in 2008 sent the housing market into a tailspin.

So what’s different this time around? Let’s break it down.

Supply and Demand Equation

After the Covid-19 outbreak, the demand for housing fell. It’s evident in the NAR’s existing-home sales report which was down for both March and April. The traffic to mega real estate websites like Zillow and Redfin fell precipitously as did new home purchase mortgage applications.

A drop in demand would have meant lower home prices, but in this case, the supply dropped faster than the demand. Total housing inventory at the end of April totaled 1.47 million units, down 1.3% from March, and down 19.7% from one year ago (1.83 million).

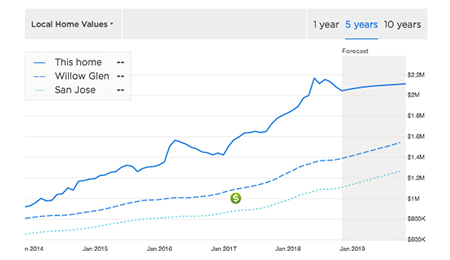

No wonder, Redfin reported that 41% of offers were subject to a bidding war over the last month. In the Silicon Valley , where I live, all but the luxury markets ($4M and up) are seeing strong buyer activity, we see buyers frequently encountering multiple offers with some going over asking.

Let’s go back in Time

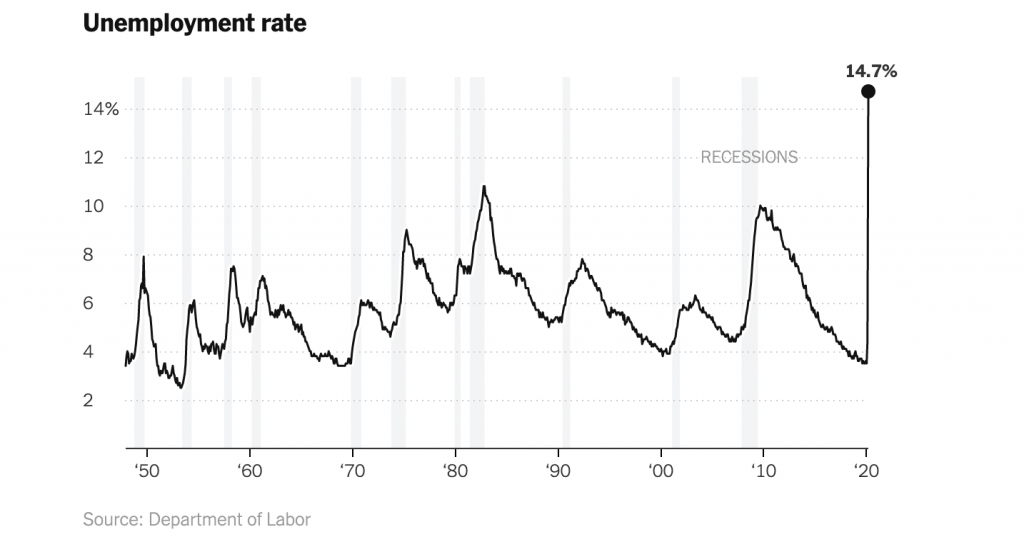

It may sound counter-intuitive, but recessions don’t necessarily mean lower prices for the housing market. In fact, they usually don’t.

Barry Habib, a two-time winner of the Zillow Pulsenomics Crystal Ball Award and CEO of MBS Highway has maintained for years that the Recession has no direct correlation with home prices.

As we can see below, only twice—in the last 2 decades, only in 1990 and 2008—did home prices come down during the recession, and in 1990 it was by less than a percent. During the other three, prices actually went up.

Will there be a Foreclosure crisis?

In 2008, irresponsible mortgage financing meant that borrowers with little to no savings were able to get 100% financing leaving the majority of the homeowners with negative equity when the home prices went down.

Things are very different right now. To begin with, nearly 40% of homeowners are “free and clear” nationally, meaning they no longer have a mortgage to pay, a number that has risen 5.5% since the great recession.

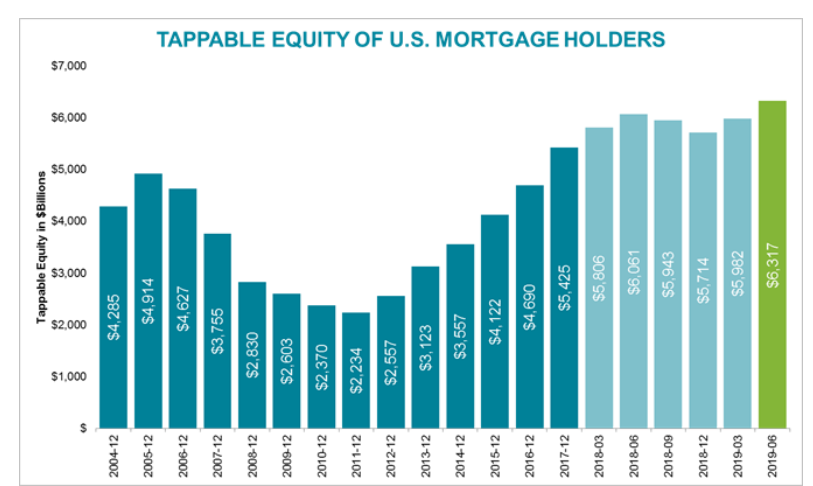

And for homeowners who currently have a mortgage, the equity in their homes has reached the highest level according to Black Knight (see the chart below). Here in Silicon Valley 78% of homeowners have at least 50% equity in their homes.

Finally, the Federal Housing Finance Agency (FHFA) has placed a moratorium on foreclosures allowing the homeowners who are impacted by unemployment or underemployment due to Covid-19 to file for Forbearance instead.

FHFA will also allow these homeowners to refinance their mortgages after they are back to making regular payments for only three months.

With Forbearance impacting almost 9% of all the mortgages, the impact can’t be discounted, but if the unemployment numbers trend lower later in the year, the overall negative impact on the housing will be minimal.

Interest in Home Buying is at an all-time high

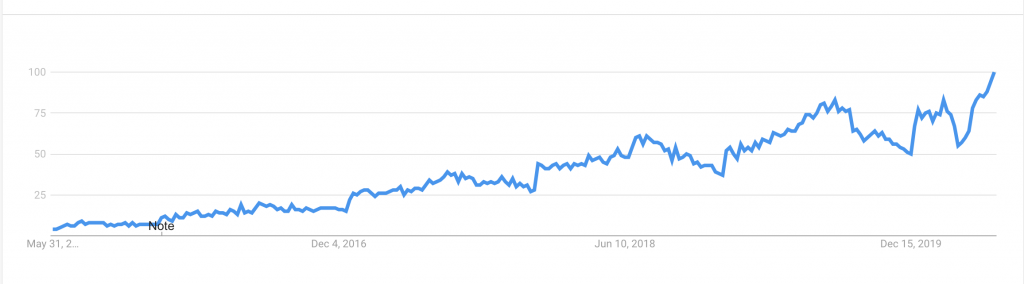

Look at some Google Trends that shows how many people are searching for a term and you will know what I mean.

The chart below shows the trend for the term “Homes for Sale Near me”

“Homes for Sale Near me” Google Search Trends

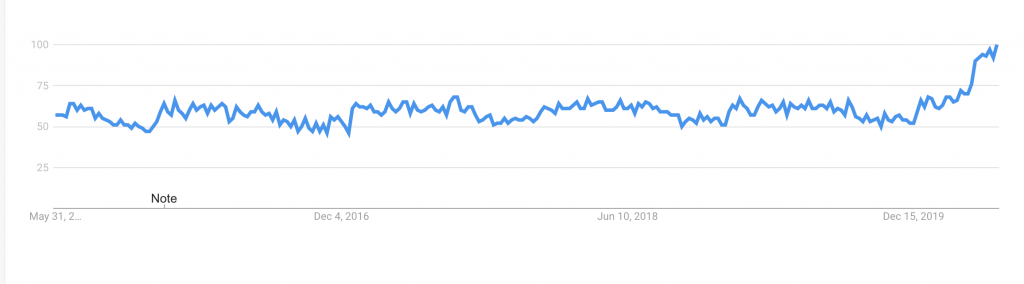

A similar trend can be noticed for the term “Buy a Home”

“Buy a Home” Google Search Trends

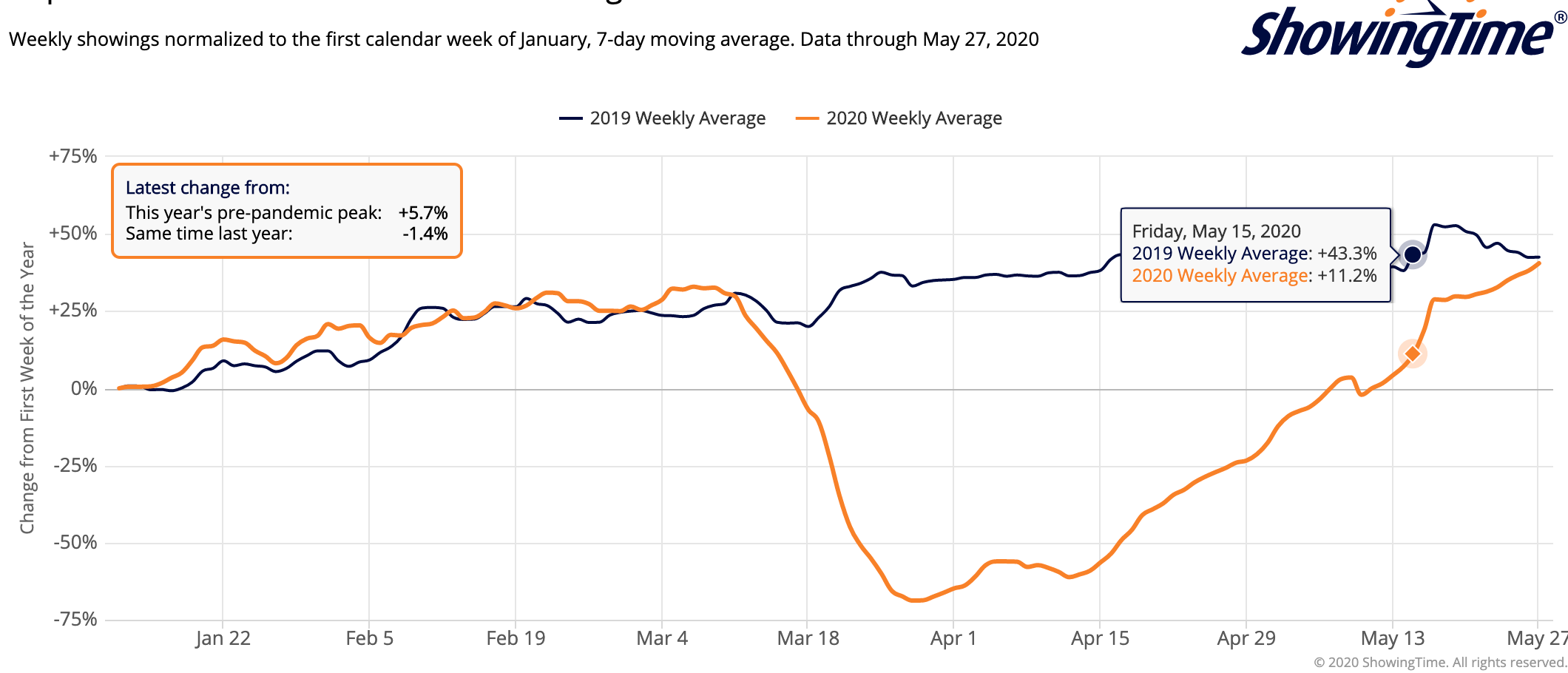

When we look at another leading indicator of Buyer demand, the number of Showing Requests, we see that number of buyers requesting property tours has already reached last years numbers even with the challenges that come with shelter in place.

What’s in store for the future?

Given the recession can be deeper than the 2008 crisis, a small drop in prices in some markets can’t be ruled out later this year. Zillow economist Skylar Olsen says Zillow is forecasting a price drop of 2 to 3 percent through the end of 2020, depending on the city, compared to where prices were in February.

However, given the tight inventory levels, solid demand from the buyers, and the lowest mortgage rates in history – don’t be surprised if the current trend of rising median home prices continues through the rest of the year.

In any case, it seems almost certain that 2021 should see robust growth in home prices once the pandemic subsides and the economy bounces back to near normal.

If you would like to understand how these market dynamics might affect your specifc plans to buy or sell during COVID-19, register for one of our free workshops on “How to Safely Buy or Sell in COVID-19”. On this Zoom session we will go into more detail about the market and how you can safely buy or sell during this challenging but opportune time.