We are currently in the midst of the most significant shift in how we live and work since the Industrial Revolution. Before and during the 19th century, people lived a primarily agrarian lifestyle on farms. But during the 1800s, there was a major migration where people began to move to urban centers to take jobs in factories. The next major shift was in the 1950s when people went from working in factories to working in office buildings.

Now, 2020 will mark the year when people went from primarily working in the office to working from home. This change has people moving from urban centers to vacation destinations, from cities to the suburbs, and from condominiums to single-family homes. Everybody wants more space nowadays. So what has this done to the real estate market in 2020?

Well for one, it’s driven up the market. The number of homes for sale was up 33% in the fourth quarter of 2020. However, the available supply of homes for sale was down by 21%. How can we have sold 33% more homes when there were 21% fewer homes? Think of it like toilet paper in a pandemic. The paper mills were pumping out toilet paper faster than ever, but consumers were buying it up way faster than the producers could keep up. That’s exactly what we’re seeing in the real estate market, only with homes instead of toilet paper.

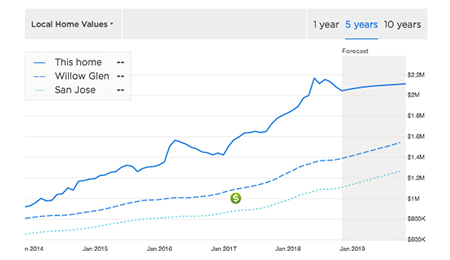

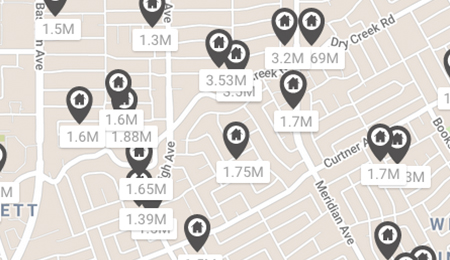

The high demand and low inventory combined are causing home prices to rise. The median home price for properties in the Bay Area went up by 13.4% in 2020. Now homes are selling much faster—the length of time they spend on the market is down by 48%!

“If you want to get a great deal on a home, now is the best time to act.”

Real estate is driven by supply and demand, and it’s tempered by interest rates and the stock market. The following are the four factors that will drive the market even higher in 2021:

1. Working from home will double the demand for housing. More people will put their homes on the market, but with our current pace of sales, inventory will stay low.

2. Our supply is low. Inventory is currently the lowest it’s been in three years, and that won’t change anytime soon.

3. Interest rates are near all-time lows. Sitting in the mid 2s, interest rates are the lowest they’ve been in 40 years!

4. The stock market is near all-time highs. Many people with new families who want to move up have an employee stock purchase program as part of their compensation. They’ve seen all that stock increase, but why? It’s because the NASDAQ went up nearly 47% last year. Many buyers are feeling flush with cash and are using it to move up.

So what’s our official forecast for the 2021 market? We expect home prices to rise by 13.5%. Inventory will remain low due to the work-from-home demand, and interest rates will rise as the economy recovers. Rates have already begun to tick up a little bit, but that doesn’t mean that homebuyers should wait to make a purchase; rising rates will cause the market to slow down, and higher rates mean bigger mortgage payments. If you want to get a great deal on a home, now is the best time to act. We’ve faced four market corrections in the last 40 years, and every one of them occurred when homes became unaffordable in the market.

If you have any questions about the market or buying and selling homes, don’t hesitate to reach out to your Real Estate Experts. We’d be happy to help you.