Falling interest rates, rising inventory, and a strong stock market are creating a more balanced market this summer.

What impact will falling interest rates, a recovering stock market, and rising inventory have on the Bay Area’s housing market this summer? In this update, I’ll walk you through how these major factors are shaping conditions and what it means for both buyers and sellers heading into the second half of 2025.

Here’s a quick overview: Real estate is driven by supply, demand, interest rates, and the stock market. Three of these are especially active right now. Interest rates are falling and the Nasdaq has reached new all-time highs. However, inventory is climbing and approaching five-year highs in many Bay Area markets.

If you’re curious about the latest market trends, here’s what you should know:

Balanced conditions. The result is a shift toward balance. After several years of a strong seller’s market, conditions are now stabilizing. These more balanced conditions haven’t been seen since 2022, creating opportunities for those who understand how to navigate the changing landscape.

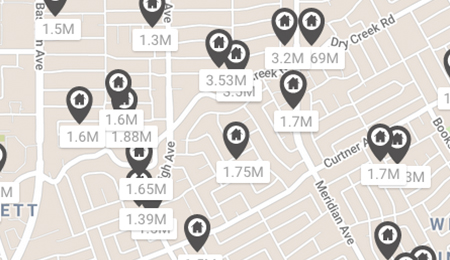

Inventory is on the rise. Inventory is up significantly from last year. In most Bay Area markets, active listings have increased by at least 50%. For Silicon Valley specifically, inventory has moved from the usual one to two months to around two to three months. This means buyers now have more choices than they’ve had in years, while sellers need to be more strategic.

“A stable summer market favors those who plan ahead.”

For sellers, this starts with competitive pricing. Homes should be priced at or slightly below market value. Preparation is also critical, as buyers are being selective. A well-presented home with strong staging, professional photography, and high-quality marketing can still generate strong interest.

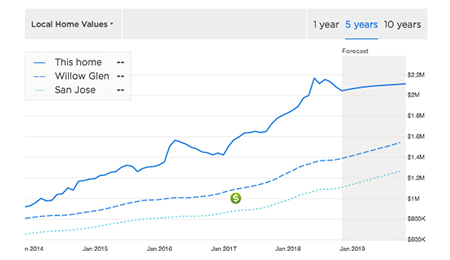

On the demand side, buyers remain active but cautious. With more listings available, they are looking for value. While home prices typically increase each year in the Bay Area, current prices are flat compared to last year. Santa Clara County is averaging around $1,040 per square foot, and San Mateo County is around $1,155 per square foot, both relatively unchanged from a year ago.

Days on market. Days on market have also increased. Homes that previously sold in seven to 14 days are now taking 21 to 35 days to sell. Condos are taking even longer, typically 25 to 49 days. Still, homes that are well-prepared and priced appropriately are selling faster than those that are not.

Rates. Interest rates have been trending downward after briefly reaching 7.1% earlier this year. Rates have since dropped to around 6.6%. Every quarter-point drop in rates adds roughly $25,000 in buying power to a $1 million loan. That means buyers have gained about $50,000 in purchasing power recently, which is a positive sign for both sides of the market.

Projections suggest that rates will remain in the mid-6% range through the rest of the year. This provides some predictability and stability for both buyers and sellers planning real estate moves.

The stock market is another positive indicator. After a major dip earlier this year, the Nasdaq has hit new highs. In the Bay Area, where many buyers work in tech, rising stock values often boost buyer confidence and liquidity. When stock options vest at high values, buyers are more inclined and financially ready to make offers.

Summer forecast. Looking ahead, the most likely scenario is a continued balanced market. If rates remain steady and tech stocks stay strong, home prices may remain flat or rise slightly, possibly up to 3%. In a more optimistic case, if rates fall below 6% and the Nasdaq keeps climbing, prices could rise 5% to 8%. A less likely scenario—around a 10% chance—is that both rates and the stock market take a downturn, which could lead to a 5% to 8% drop in home prices.

For buyers, the current market offers value. If rates continue to drop, locking in financing early can be a smart move. Properties on the market for three weeks or longer may be candidates for price reductions, and buyers can often negotiate concessions that improve affordability.

For sellers, preparation and pricing are essential. Buyers are selective, so staging and presentation matter more than ever. It’s also important to monitor tech market trends. A strong stock market gives buyers more confidence and more funds to complete a purchase.

This summer’s market is defined by opportunity, but also by strategy. Whether you’re buying, selling, or investing, having a clear plan based on current market dynamics is key to making the most of the season. If you have questions or need guidance, just reach out. You can call me at 408-596-4490 or send an email to Brett@TheRealExperts.com. I look forward to hearing from you.