In the real estate world, those with the most knowledge are usually the most successful. Today we are delighted to be joined by Rich Dayton, a certified specialist in real estate trust planning and probate law, to talk about a simple mistake that homeowners make without realizing it, a mistake that could end up costing you tens of thousands of dollars.

Considering Selling? Click here for a FREE Home Price Evaluation

Click here to access off-site properties

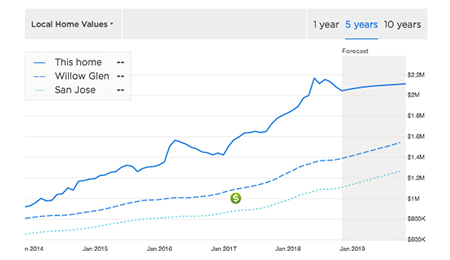

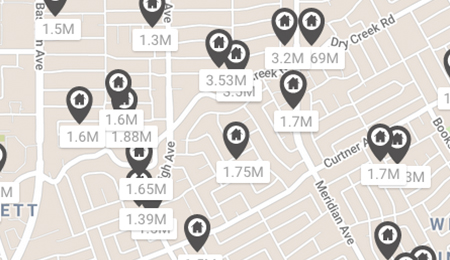

So, what is this mistake? Well, according to Rich, 90% of people in our country do not have any form of estate plan in place and that can be a very serious problem for them. If you don’t have something like a living trust, power of attorney, or health care directive setup, you can be subject to probate. Probate is based on the gross value of a property. With the average price of a property in Silicon Valley at about $1 million, your probate could run up to $50,000.

If you have a plan in place with the help of a professional like Rich, it’s a fraction of the cost of the risk you are exposing yourself to without one. It also helps your family in case of untimely death, and takes any extra worrying out for them.

One other problem that many people have has to do with a revocable living trust. Many times, people fail to fund the real estate, with the title of the property in the name of the trustees rather than in their individual names.

Another thing to watch out for is exposing your property through refinancing. Most mortgage companies require you to take the property out of your trust, put it in your name, and if you don’t take the action to affirmatively put it back in, you’ve exposed that property to probate again.

If you want to avoid these problems, give Rich a call. He can also offer you a complimentary consultation, click the link in the video to sign up!