A rare mix of falling rates and limited supply is shaping the Silicon Valley housing market. I’ll tell you what to expect next.

CLICK HERE TO SEE THE MARKET UPDATE SLIDES

With falling interest rates, soaring stock market, and low inventory, many are wondering: What’s going to happen to the Silicon Valley housing market in 2026? Will this open doors of opportunity…or risks?

As 2026 begins, the market is experiencing a rare mix of conditions that directly affect both buyers and sellers, making timing and strategy more important than ever. Let’s talk about that and more in this winter market update and forecast.

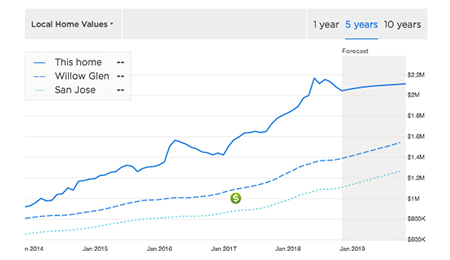

Why Silicon Valley real estate behaves differently. Over the past 40 years, Silicon Valley real estate has averaged 7.66% annual appreciation, double the national average. Limited land, a strong tech economy, and an unparalleled concentration of financial and intellectual capital drive this long-term performance.

Even during major downturns, including the dot-com crash and the Great Recession, real estate prices declined far less than the stock market and recovered more quickly

“We might see continued price stability with modest gains if rates remain near 6%.”

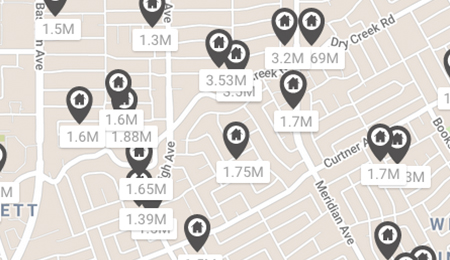

Current market conditions entering 2026. Inventory in Santa Clara and San Mateo counties is at a five-year low, keeping the market in seller territory while moving closer to balance. Homes are taking longer to sell, buyers are more cautious and value-driven, and pricing has remained largely flat, with values fluctuating by only 1% to 2% year over year.

Mortgage rates have dropped from over 7% last year to just above 6%, a critical level that historically determines whether prices rise, fall, or stabilize.

The role of interest rates and the stock market. Interest rates remain the primary driver of short-term market movement. Rates below 6% tend to increase demand and push prices higher, while rates above 7% typically soften prices. At the same time, the Nasdaq has risen more than 20% year over year, creating confidence and liquidity for down payments, particularly among tech employees.

However, these gains are concentrated among a small group of companies, leading to stronger demand in specific price ranges rather than across the entire market.

What to expect for the rest of 2026. The most likely outlook for 2026 is continued price stability with modest gains if rates remain near 6%. A stronger scenario could emerge if rates fall further, driving renewed buyer competition and price growth, while higher inflation and rising rates would place downward pressure on prices. Mortgage application activity is already increasing, signaling that buyer demand may rise in the months ahead.

How buyers and sellers should approach 2026. The winter market represents one of the most balanced conditions Silicon Valley has seen in years. Sellers must focus on accurate pricing, preparation, and presentation to succeed, while buyers face a narrowing window before competition increases. Watching interest rates, inventory levels, and the Nasdaq will be critical for anyone planning to make a move in 2026.

If you’d like to learn more or have questions, feel free to reach out at (408) 317-0506, or email Brett@TheRealExperts.com. I’m happy to help however I can.